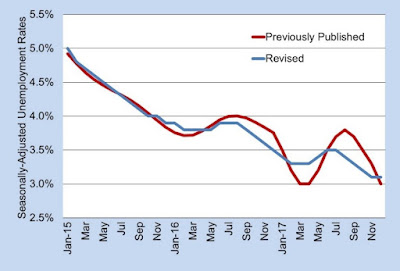

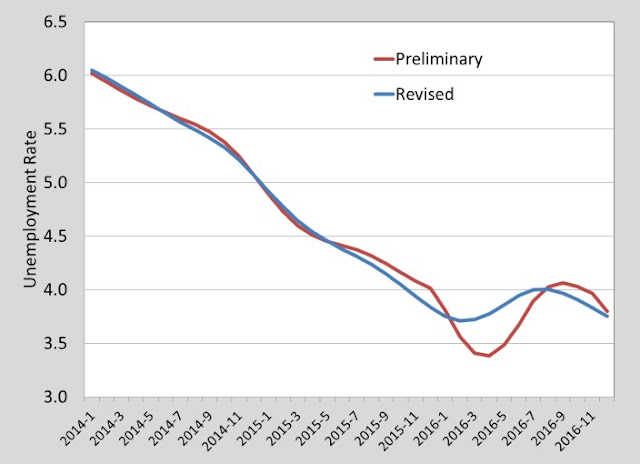

Employment Outlook to 2026 Workforce conditions in Maine are very tight in 2018, with unemployment and other measures of labor market slack at historically low levels. This is a positive development for individuals, but a challenge for employers who are concerned about future labor availability. This blog provides context to how this situation developed, then looks at our forecast for employment through 2026. How We Reached This Point From the early 1960s until 2007, employment in Maine nearly doubled. The rate of growth slowed in the 1990s, and, except for the decline and recovery during and after the 2008 and 2009 recession, employment has been relatively unchanged over the last decade. This recent lack of growth is because the prime working-age population of the state has contracted modestly. Combined with strong economic conditions, this has created a very competitive hiring and retention environment that has driven inflation-adjusted average wages up at the fastest...