2016 Workforce Data Revisions: Stronger Growth Than Previously Thought

Annual revisions to labor force and nonfarm payroll jobs estimates have been published. Those revisions, based on more complete data, indicate the unemployment rate was little changed throughout 2016 and nonfarm payroll job growth was stronger than previously thought. Data cited in this brief is seasonally adjusted.

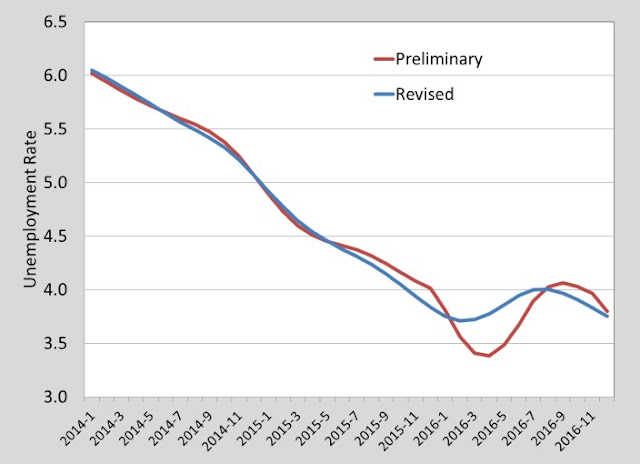

Unemployment Rate

Estimates released on a monthly basis throughout the year indicated that unemployment reached lows of 3.4 percent in the spring and highs of 4.1 percent in the fall. Revisions based on more complete data indicate unemployment was not quite as low in the spring (3.7 percent) or as high in the fall (4.0 percent), ending the year at 3.8 percent in December. Given margins of error in the survey sample, there was essentially no change in the unemployment rate last year.

Unemployment rates were below 4 percent in 12 of the last 15 months, which is historically unusual. In the last 40 years, unemployment was below 4 percent in two other short periods, for 18 months from 1987 to 1989 and 20 months from 1999 to 2001.

Unemployment Rate (seasonally adjusted)

The broadest measure of labor underutilization, known as U-6, declined to 8.7 percent in 2016. U-6 includes people who want a job but were not engaged in work search and those working part time who want full-time work, as well as the unemployed. In the 14 years the measure has been available it was lower only in 2006.

Nonfarm Payroll Job Growth

Monthly

estimates throughout the year indicated that nonfarm payroll growth averaged a

modest 3,000 jobs in 2016, following a gain of 4,400 jobs in 2015. Revised data

indicates growth last year was a much stronger 6,700 jobs, the largest gain

since 2000, and the gain in 2015 was also stronger at 5,500 jobs. The average

of 617,300 jobs in 2016 is just 400 shy of the 2007 pre-recession peak. The

private sector reached a new high of 517,300 jobs. Last year was much stronger

with 6,700 jobs, the largest gain since 2000, and the gain was in 2015 was also

stronger at 5,500 jobs. the Average of 617,300 jobs in 2016 is just 400 shy if

the 2007 pre-recession peak. The private sector reached a new high of 517,300

jobs.

The largest job gains in 2016 were in the healthcare, hospitality, and construction sectors. The number of manufacturing jobs was unchanged, as gains in transportation equipment (including shipbuilding and aircraft parts) and other industries offset the loss of 700 paper mill jobs. Government added 600 jobs, 500 of which were in federal government (mostly Department of Defense at Portsmouth Naval Shipyard). State government shed jobs for the eighth consecutive year (-200 in 2016) and local governments added 300 jobs, the first rise in ten years.

Recent Growth and Short-Term Prospects

According to U.S. Census Bureau estimates, the population of Maine has been little changed since 2008 and the working-age population has declined. Throughout the recovery, job growth was driven by reductions in unemployment. Once unemployment reached the very low levels it has been at for more than a year, it appeared there would be little more job growth.The gain of 6,700 jobs in 2016 was more than the reduction in unemployment and more than expected. It appears that population growth may have been stronger than the Census Bureau has estimated. If so, that means more people have moved into the state than their estimates indicate, though we will not know for certain until after the next decennial headcount in 2020.

Prospects for growth going forward will increasingly rely on in-migration from other states. The bulk of the baby boom generation is 53 to 64 years of age in 2017, so there will be increasing numbers of retirements in the years ahead.